Dear Sir/Ma

Invitation to Join Genix Summit International Ltd as a Shareholder

I hope this letter finds you in good health and high spirits. I am writing to formally introduce you to Genix Summit International Ltd, an indigenous Nigerian company that I am proud to be a part of, and to extend a sincere invitation for you to join us as a shareholder.

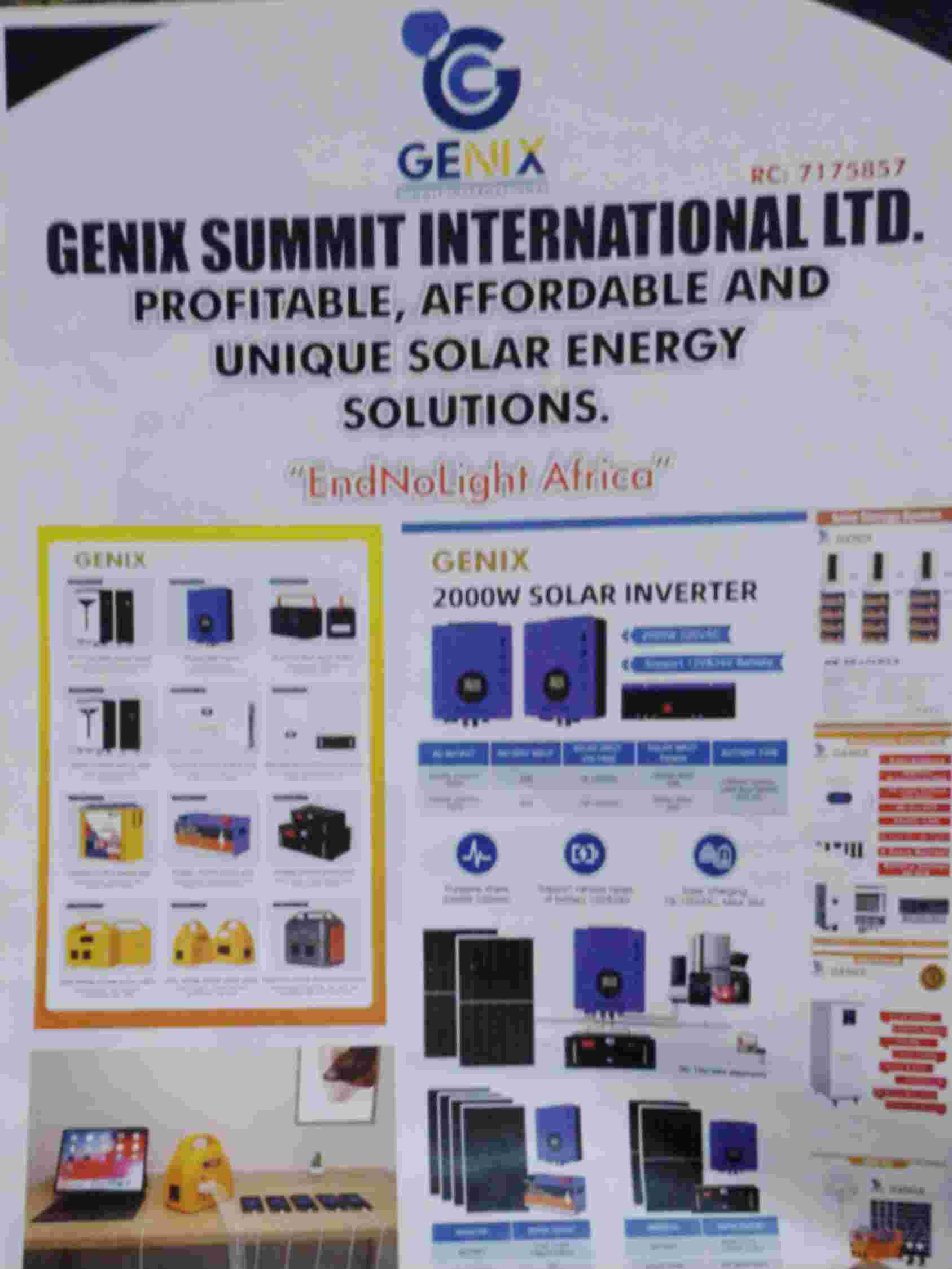

Genix Summit International Ltd is committed to addressing Nigeria's energy challenges through innovative, affordable, and highly effective solar energy solutions.

Our focus is on creating profitable, scalable, and sustainable energy systems that not only serve the needs of underserved communities but also position us as a major player in the renewable energy sector across Africa.

Our solutions are uniquely designed to meet the growing demand for clean and reliable energy. Through strategic partnerships, local innovation, and a strong distribution network, we have already started making significant impacts, and the future looks even brighter.

As we prepare to scale operations and expand our market reach, we are inviting a select number of visionary individuals to become part of this growth by investing in the company. I believe you share in the values of sustainability, innovation, and progress, and that your involvement—both financially and intellectually—would add great value to our mission.

As a shareholder, you will be entitled to equity in the company, annual dividends, and access to strategic decision-making forums. More importantly, you will be part of a forward-thinking enterprise poised for national and international success.

Thank you for considering this opportunity. I truly hope you’ll choose to be part of this exciting journey with us at Genix Summit International Ltd.

For more information call 07035615215.

Invitation to Join Genix Summit International Ltd as a Shareholder

I hope this letter finds you in good health and high spirits. I am writing to formally introduce you to Genix Summit International Ltd, an indigenous Nigerian company that I am proud to be a part of, and to extend a sincere invitation for you to join us as a shareholder.

Genix Summit International Ltd is committed to addressing Nigeria's energy challenges through innovative, affordable, and highly effective solar energy solutions.

Our focus is on creating profitable, scalable, and sustainable energy systems that not only serve the needs of underserved communities but also position us as a major player in the renewable energy sector across Africa.

Our solutions are uniquely designed to meet the growing demand for clean and reliable energy. Through strategic partnerships, local innovation, and a strong distribution network, we have already started making significant impacts, and the future looks even brighter.

As we prepare to scale operations and expand our market reach, we are inviting a select number of visionary individuals to become part of this growth by investing in the company. I believe you share in the values of sustainability, innovation, and progress, and that your involvement—both financially and intellectually—would add great value to our mission.

As a shareholder, you will be entitled to equity in the company, annual dividends, and access to strategic decision-making forums. More importantly, you will be part of a forward-thinking enterprise poised for national and international success.

Thank you for considering this opportunity. I truly hope you’ll choose to be part of this exciting journey with us at Genix Summit International Ltd.

For more information call 07035615215.

Dear Sir/Ma

Invitation to Join Genix Summit International Ltd as a Shareholder

I hope this letter finds you in good health and high spirits. I am writing to formally introduce you to Genix Summit International Ltd, an indigenous Nigerian company that I am proud to be a part of, and to extend a sincere invitation for you to join us as a shareholder.

Genix Summit International Ltd is committed to addressing Nigeria's energy challenges through innovative, affordable, and highly effective solar energy solutions.

Our focus is on creating profitable, scalable, and sustainable energy systems that not only serve the needs of underserved communities but also position us as a major player in the renewable energy sector across Africa.

Our solutions are uniquely designed to meet the growing demand for clean and reliable energy. Through strategic partnerships, local innovation, and a strong distribution network, we have already started making significant impacts, and the future looks even brighter.

As we prepare to scale operations and expand our market reach, we are inviting a select number of visionary individuals to become part of this growth by investing in the company. I believe you share in the values of sustainability, innovation, and progress, and that your involvement—both financially and intellectually—would add great value to our mission.

As a shareholder, you will be entitled to equity in the company, annual dividends, and access to strategic decision-making forums. More importantly, you will be part of a forward-thinking enterprise poised for national and international success.

Thank you for considering this opportunity. I truly hope you’ll choose to be part of this exciting journey with us at Genix Summit International Ltd.

For more information call 07035615215.

0 Comentários

0 Compartilhamentos

116 Visualizações