Warren Buffett just dumped $116 million of this stock

Warren Buffett just dumped $116 million of this stock

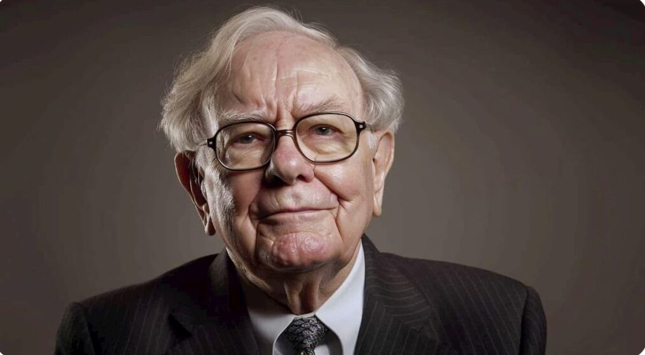

Warren Buffett, the ‘Oracle of Omaha’, is the paragon of value investing. Instead of making risky, short-term trades, his approach is based on finding quality businesses trading at attractive prices.

The billionaire and his company, Berkshire Hathaway (NYSE: BRK.B), have been net sellers of stocks in recent quarters. Buffett is also sitting on a record-breaking cash position — potentially positioning Berkshire for future market opportunities.

Berkshire’s latest 13-F filing, published on February 14, provided an updated snapshot of Buffett’s stock holdings as of December 31, 2024.

However, it seems that the billionaire and philanthropist has been particularly active in February — both in terms of purchases and liquidations. On top of a $35 million investment in Occidental Petroleum stock (NYSE: OXY), Warren Buffett also made a $50 million purchase of SiriusXM stock (NASDAQ: SIRI) in February. This was rounded out by a $31 million sale of DaVita stock (NYSE: DVA).

We picked up yet another sale of DVA stock — as a Form 4 filing has revealed that Buffett made additional sales of DaVita shares between February 14 and February 19.

In total, Buffett made 18 transactions, encompassing 750,000 DVA shares. The transactions were executed at prices ranging from $150.77 to $159.15 per unit of DaVita stock.

With the size of each individual transaction and the average price per share taken into account, we estimates that the value of the billionaire’s trade was $116,055,616.

This latest sale represented a 2% decrease in Buffett’s stake in the dialysis company — the billionaire continues to hold 35,142,479 shares, representing roughly 44% stake, making him the company’s largest shareholder.

Warren Buffett most likely trimmed his stake following DaVita’s disappointing Q4 2024 earnings call. Despite earnings per share (EPS) and revenues beating estimates, the company issued weak guidance. In the immediate aftermath of the report, prices plunged 11% in a day, down to $157.42 — by press time, DVA stock was trading at $154.50, bringing losses in the last 30 days up to 9.10%.

Readers should note that the billionaire’s earlier $31 million sale was due to a previously agreed share repurchase plan. However, with a disappointing outlook and the company’s largest shareholder trimming its stake, markets have become jittery when it comes to DVA stock — and it seems that 2025 will be a year full of headwinds for the company.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness