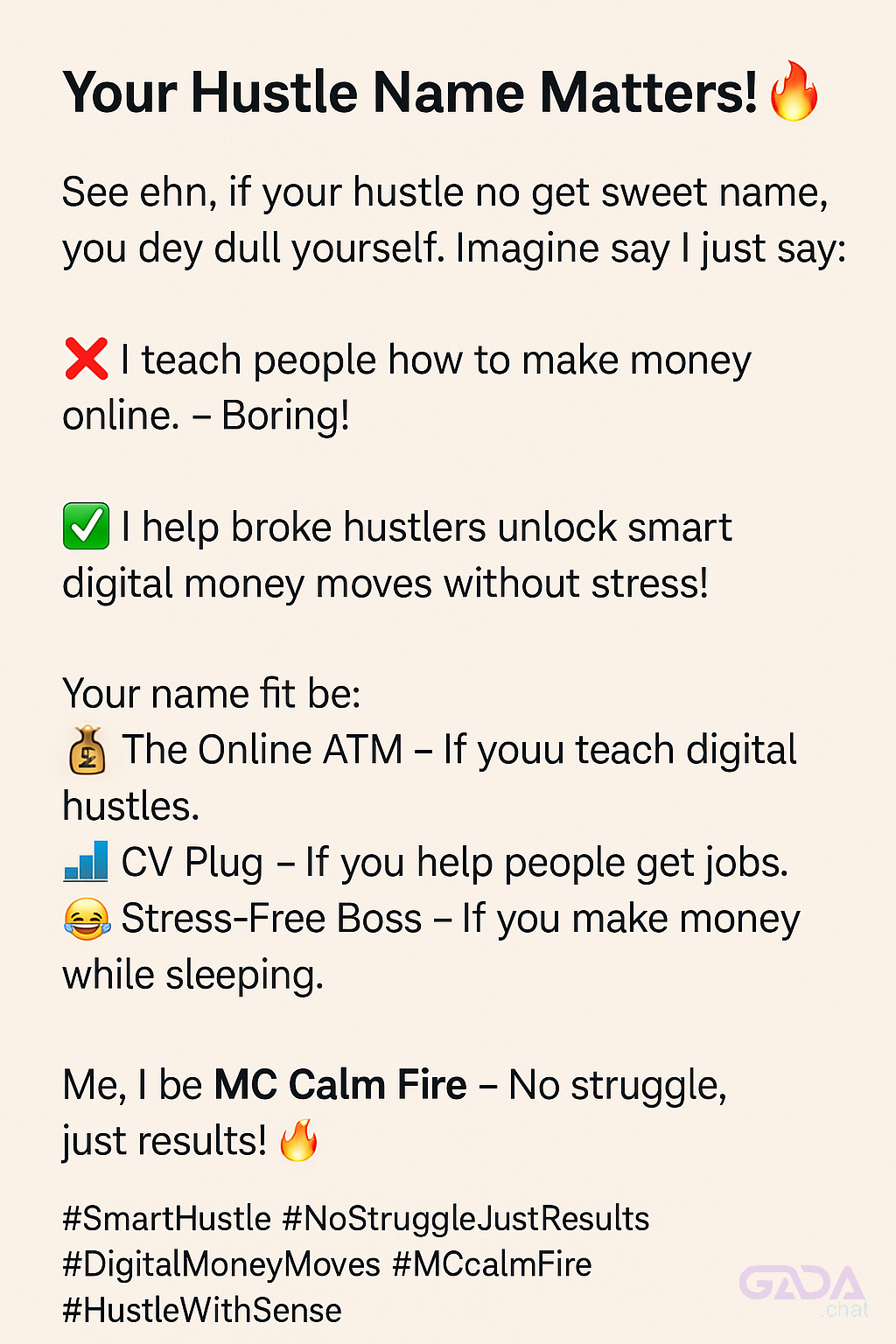

#SmartHustle #No struggle, Just Results, #Digitalmoneymoves #McCalmFire

0 Commentaires

0 Parts

258 Vue

0 Aperçu